Everything you need to know about professional expenses 💸

Read in 3 minutes

It’s more than likely that you’ve already heard someone tell you to “keep your receipts so that you can claim tax savings later on”.

Before you dive in, next to this post, we also created a Google for professional expenses: you can search there all the expenses you want to claim and see right away whether you can deduct them, and to what extent.

Professional expenses: the more the merrier? 🏰

At its core, the principle of taxation for self-employed workers in Belgium is very simple: you get taxed on what you earn. In other words, the more you earn, the more you pay taxes.

As with everything in life though, there is a small but important nuance: Belgian tax authorities understand that you need to spend money to make your business grow. They believe it should thus be the profit generated by your activity that should be taxed, not your mere revenue. In other words, it means that you will eventually be taxed on what you earn minus the expenses that you make for your business. It does also mean that the higher your costs, the lower your net income and the lower the amount of taxes that you will be paying.

If spending money may make you feel good, spending it wisely makes it even better – because, in the end, not every expense can be considered as a professional cost…

So, what is a professional expense? 🚢

Professional expenses obey a strict definition, defined by 4 criteria. You can surely deduct a given expense if you answer yes to every question below:

- Is the expense directly connected to your activities as a self-employed?

- Does the expense help your business grow?

- Is made in that same year where you deduct it from your tax base?

- Can it be proven with invoices or receipts?

Some business expenses are easily recognizable, like the purchase of your toga when you are a lawyer, or safety shoes when you are working in construction. You would otherwise never incur those costs: these are professional costs.

Another straightforward example are your social contributions. You would not pay them if you were not self-employed: these are professional costs as well, 100% deductible.

Certain expenses cannot fully be attributed to your business: we call these expenses “mixed costs”. You will only deduct the “professional part” of those expenses to your taxes. Also, some expenses are only deductible for parts of the total amount: gifts to customers are deductible for 50%, without the VAT. Restaurant expenses are only deductible for 69%, the rest gets rejected.

Finally, you also have to prove that you have actually incurred all these costs: an invoice, a proper VAT receipt, would do the job.

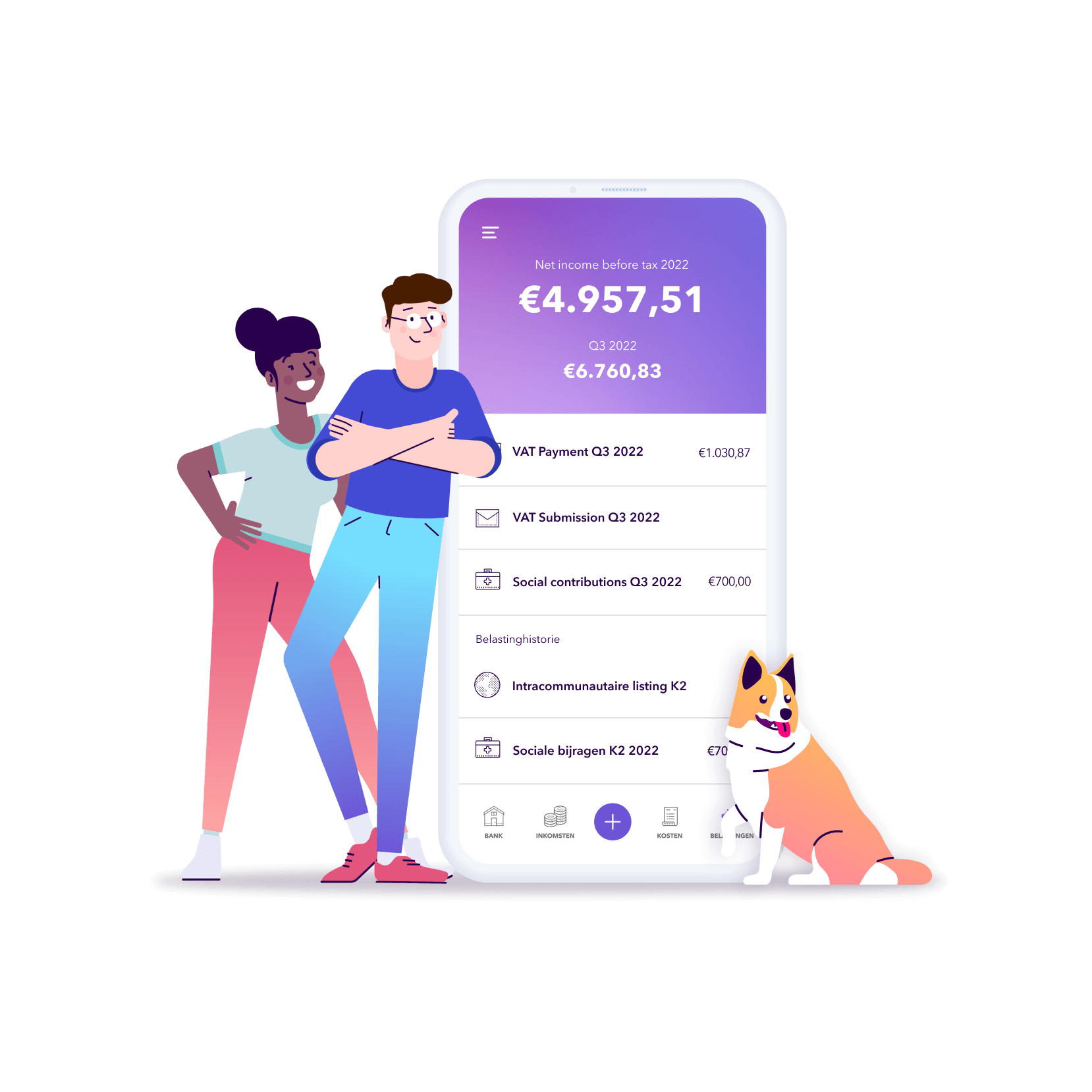

Don’t forget to keep these documents though, the government can still ask for this proof 7 years after you have submitted it for the first time. Time to get some extra shoeboxes! Or start using Accountable so you can capture them straight from the camera of your smartphone. Thanks to the Digital Act, this is considered evidence in first instance in case of audit. Beware, auditors still have the right to ask for the paper version, if they wish.

💡 If you make bigger investments, like a new computer, for example, you can write off the purchase of this investment over a number of years.

Pitfalls you should absolutely avoid 🎢

Any professional expense should have a direct link to your professional activity: for example, if a tax inspector sees a VAT receipt for a dinner in a restaurant on Valentine’s Day, the chances will be that she or he will get a little suspicious ;-).

The same thing applies to paying for restaurants in the weekend, by the way. Don’t give in to all those potential temptations that everyone, especially tax inspectors, knows! If you tempt the devil, be ready to offer a bulletproof justification & potentially accept the requalification as personal expense.

Final tip: flat-rate expense allowances, is this the right choice for me? 🔒

Since 2018 a lot of things have changed for self-employed workers in Belgium: all self-employed individuals can opt for fixed-rate professional costs instead of actual professional costs.

In practice, this means that you no longer have to save all those receipts in your shoebox at home or your wallet. You can simply deduct 30% (up to 4880 euro) from your income, excluding the purchase of any material and social contributions. In other words, you can deduct the purchase of material, your social security contributions and a maximum of 4880 euro from your taxable income.

This might be a good idea if you are a self-employed, preferably a self-employed in a secondary occupation, with very limited costs. Otherwise, note that capturing professional costs in Accountable is very easy. It is worth testing it out before giving up on actual professional costs. In most cases, it is the best option, financially speaking.

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.