Never worry about your taxes again

File your taxes with confidence. Join 40,000+ self-employed in Belgium 🇧🇪 who trust Accountable for expert support, AI-powered accuracy, and hassle-free tax filing. The #1 app for finances, built for you.

Your questions

answered

Our team helps with questions about bookkeeping and taxes via phone, chat or email.

Unique tax

guarantee

Accountable guarantees your tax returns against fines, including those resulting from personal mistakes.

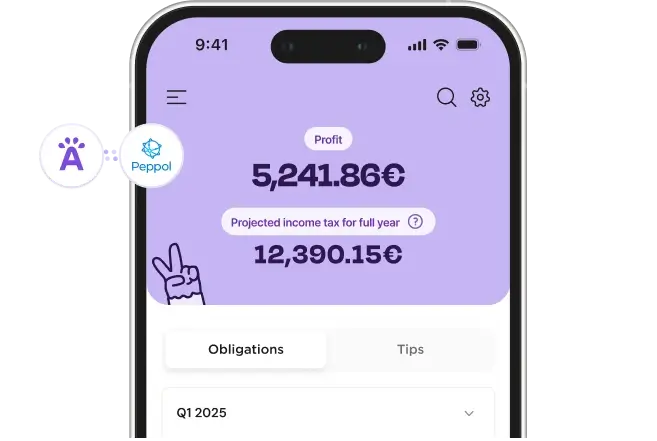

PEPPOL registration & unlimited invoicing

Sign up for free and send unlimited invoices from your smartphone with our free plan.

Hear it straight from our users

Marciela, Shop owner and designer about Accountable Banking

“Automatic tax savings with my bank account – so convenient.”

Lucas, Freelance consultant about Accountable Invoicing

“Moving to PEPPOL was seamless with everything in one place”

Karim, Owner of a coffee shop about Accountable Bookkeeping

“Scanning and attaching receipts with automatic recognition of all content. Magic.”

Layla, Business owner and architect about Accountable Taxes

“No need to know about accounting and taxes.”

Your questions answered instantly by our

AI Tax Advisor

Get instant answers to all your tax questions 24/7 – covered by our Tax Guarantee

Ask me anything about your taxes!

All our tax and accounting knowledge is manually vetted by experts.

AI can be wrong. Consider checking important information. Conversations may be reviewed for quality assurance.

What data is shared?

Supported by our Tax Coaches whenever you need a human touch

Tax Coach Belgium

Cassie

Tax Coach Belgium

Simon

Tax Coach Belgium

Eniola

Tax Coach Belgium

Romain

Tax Coach Belgium

Agata

Being self-employed means wearing many hats. You’ve got things under control, but sometimes it helps to double-check. That’s why our customer success team is here to answer your questions—so you can move forward with confidence.

Let the app manage your admin: it’s its job

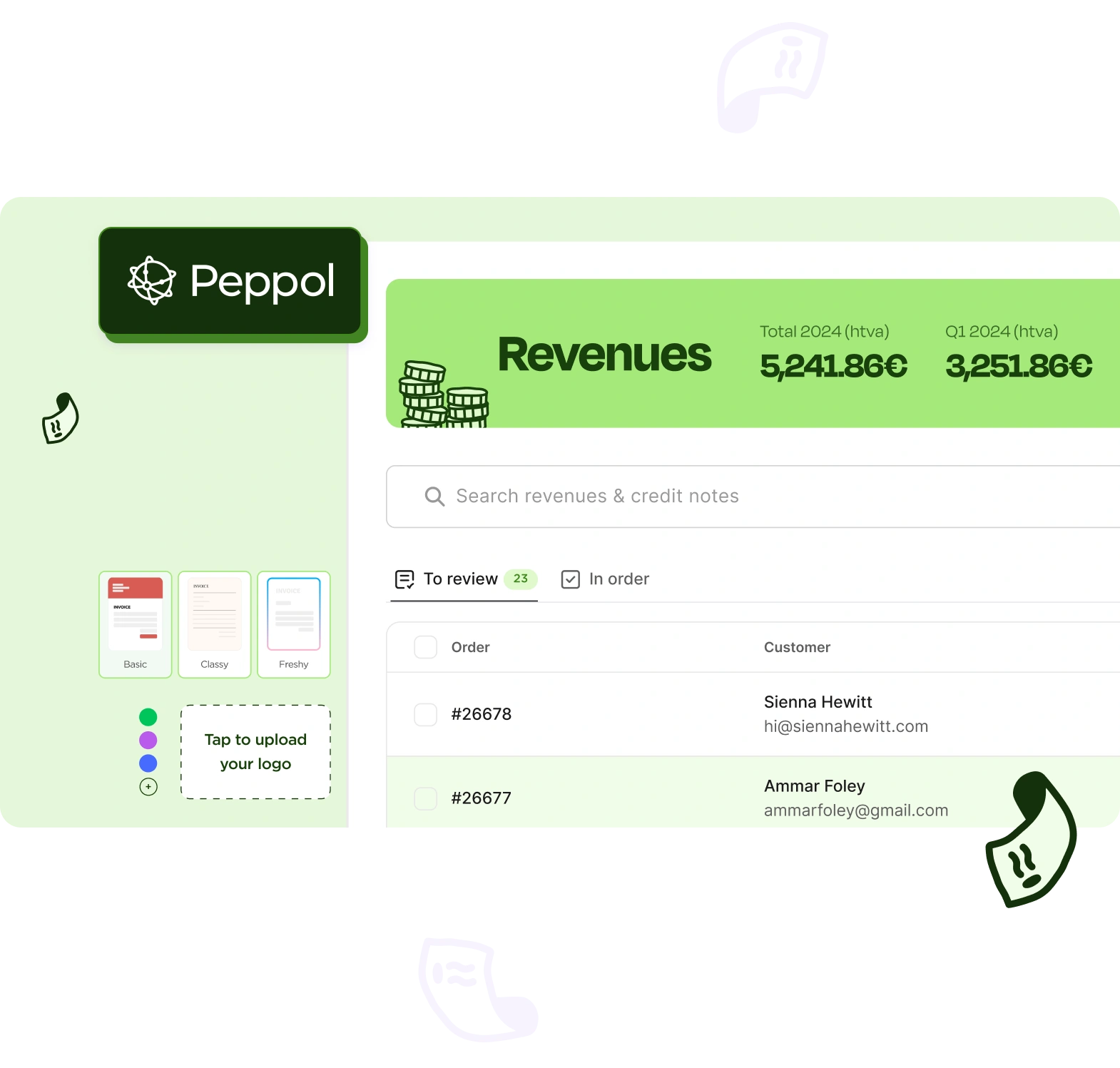

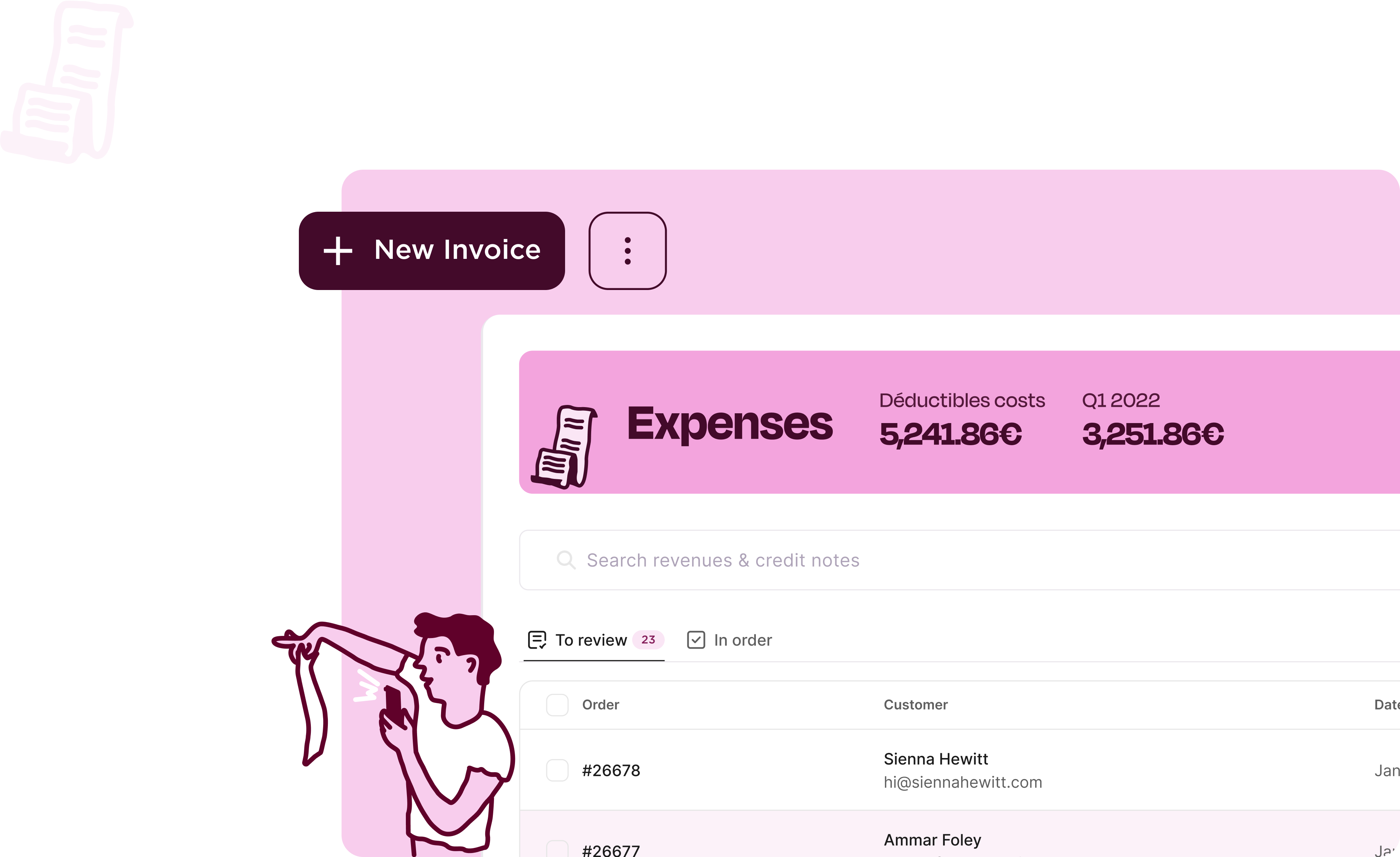

Unlimited invoicing for free

Avoid costly mistakes and send invoices that your client can pay directly

- Create professional invoices in less than 2 minutes

- Send your invoices correctly and free of charge with PEPPOL [New for 2026]

- Automate your invoice creation with invoice duplication and recurring invoices

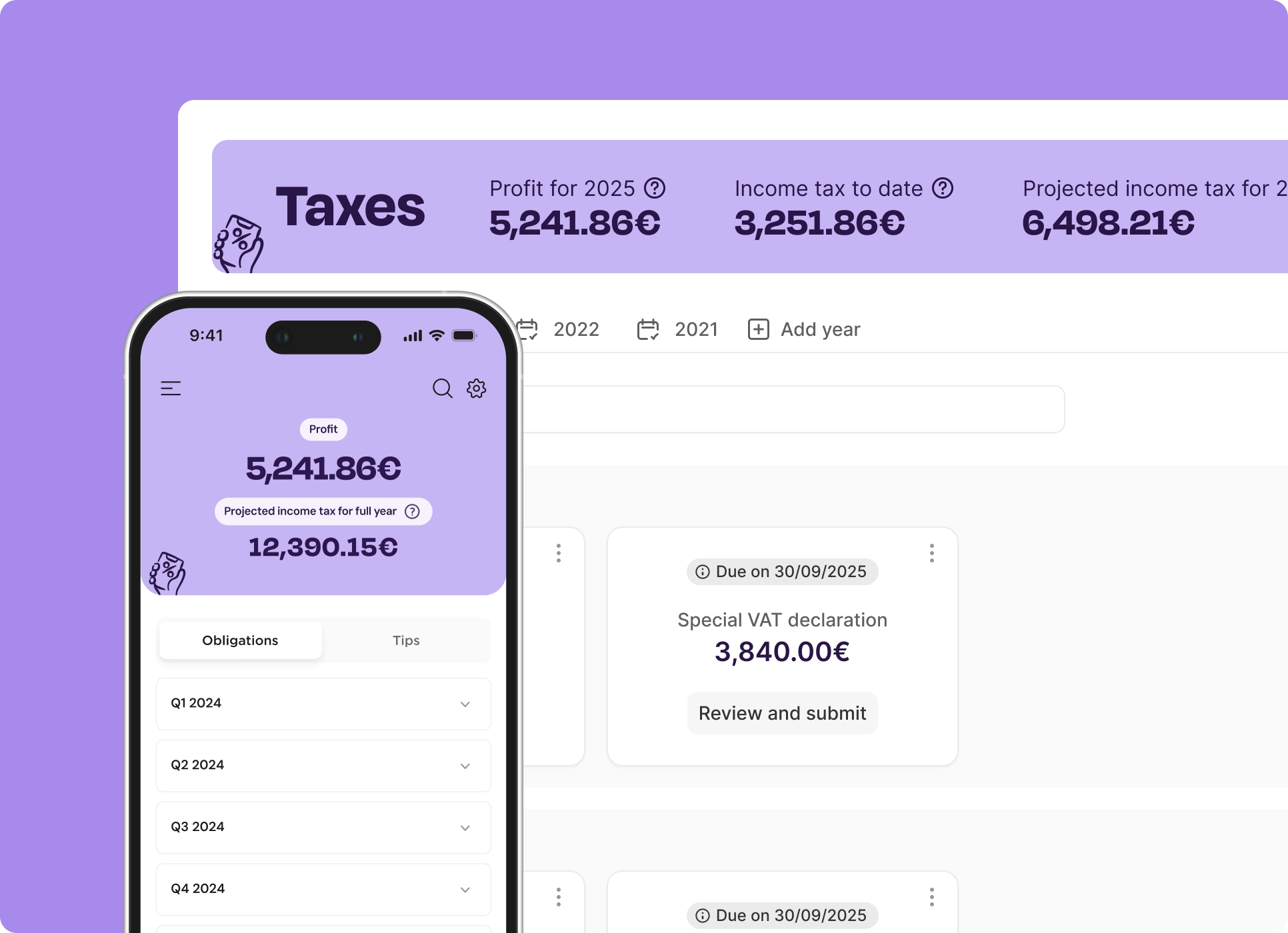

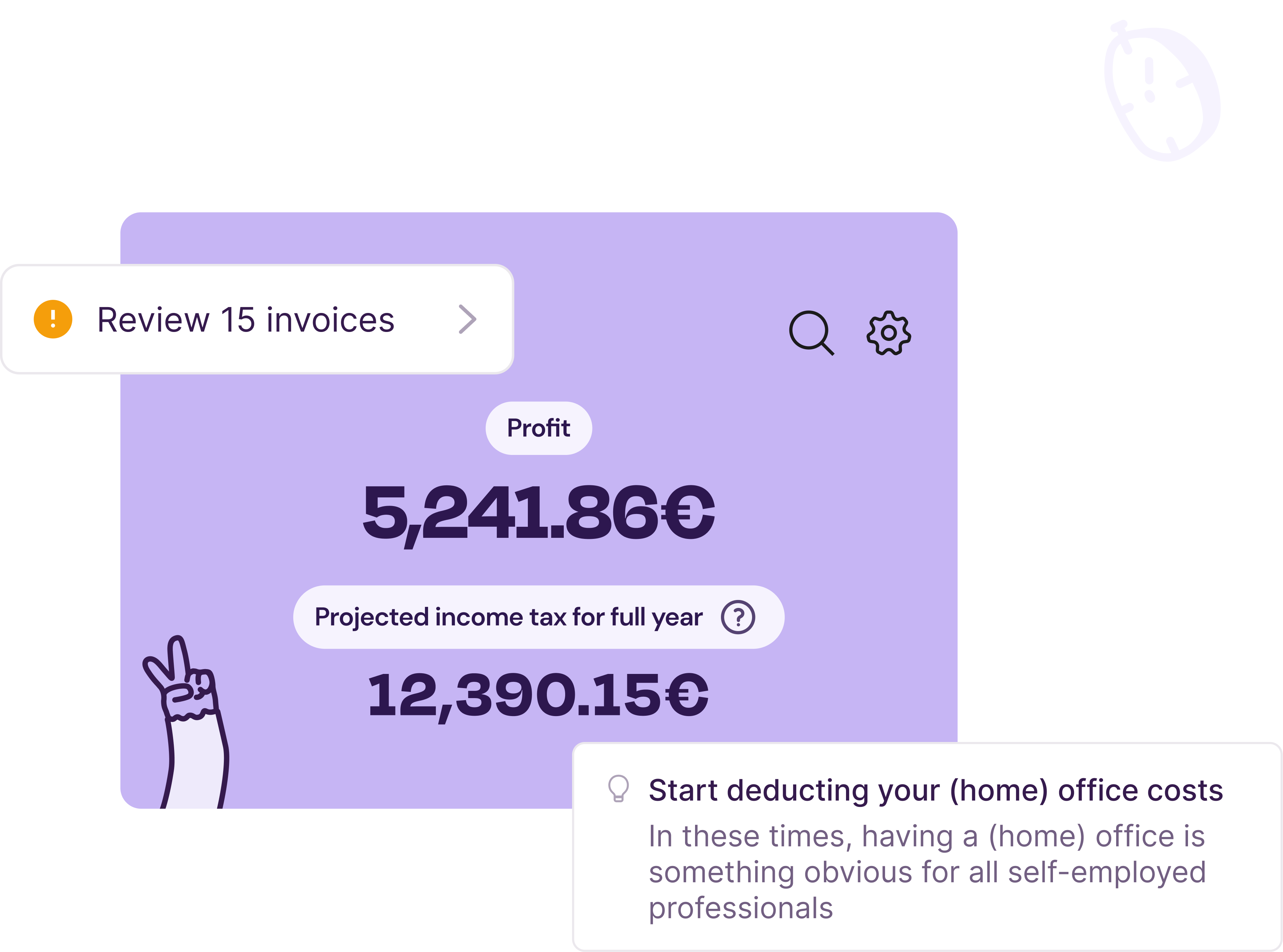

See how much you really earn after taxes

You know what you owe in taxes, VAT, and social contributions at any time

- Get financial clarity by always knowing how much tax you have to pay

- Guaranteed 100% correct tax returns

- Gain independence from accountants with deadline reminders, tailored tax tips and your personal AI Tax Advisor

Never lose a receipt again

Automate your expense management and save taxes with every receipt

- Learn what to deduct with personalized tax tips for each expense

- Save time with instant receipt scanning and AI auto-recognition

- Get organised by digitising your bookkeeping and automatic import of e-invoices through PEPPOL

Open your free business account

Start with Accountable Banking or connect your existing bank accounts and the app shows you how much money is left after taxes.

- Safely set aside the right amount for your taxes

- Full business banking without account fees

- Pay everywhere with your Mastercard, Apple Pay & Google Pay

As seen in the press

Our partners

Your tax solution, with or without an accountant

Take full control of your admin or get high-added-value advice from your accountant. With your consent, they access your documents in the app.

Looking for an accountant?

Receive on-demand support from certified accountants in Belgium, within a few days and at a transparent price.

See the accounting servicesAre you an accountant?

You will love Accountable for Accountants: free, intuitive, and made for accountants who want to focus on advising, not on encoding.

Learn more