How are NFTs taxed?

Read in 4 minutes

Do you already have NFTs, or are considering buying some? If so, then make sure you’re aware of the tax rules related to these ‘non-fungible tokens’. Whether or not you need to pay tax on NFTs depends mainly on your individual behaviour as an investor.

What is an NFT?

An NFT – or to use the full name, a non-fungible token – is best described as a digital certificate of ownership. It’s a contract that establishes who owns a specific piece of digital content or digital art.

Photos, text, music or video footage are all forms of digital content that can be linked to an NFT. And, as with any form of art, its value depends on what the market is willing to pay for it.

NFTs became more widely known not too long ago when Jack Dorsey, the co-founder of Twitter, sold his very first tweet as an NFT for an astronomical sum. In this case, the NFT is the digital contract that establishes ownership of the tweet.

This digital content is offered for sale on NFT marketplaces, such as OpenSea, for example. In the NFT world, euros are not much use, as these tokens are bought and sold using cryptocurrencies, such as Ethereum.

Blockchain guarantees the ‘non-fungible’ nature of your NFT

The ownership of your NFT is guaranteed via a blockchain. In very simple terms, a blockchain is a public database where anyone can verify your ownership of an NFT, without being able to make any changes to the token, or certificate. Hence, its ‘non-fungible’, or non-replaceable, nature.

Do you have to pay taxes on the sale of NFTs?

NFTs are still fairly new, but the rules are already starting to get a bit clearer. The question of whether your NFT profits are taxed or not depends on your individual investor profile.

There are three possible scenarios:

- The ‘prudent investor’: exempt from personal income tax

Are you a cautious investor who diversifies your portfolio and chooses mainly low-risk investments? If you invest only a small portion of your capital in NFTs, alongside various other investments, the tax authorities are likely to consider you a ‘prudent’ investor. As with capital gains on shares, you are exempt from tax on your NFT profits.

- The NFT speculator: 33% tax on ‘miscellaneous income’

You’ve never invested before, but suddenly, you decide to invest all your money in NFTs, only to resell them shortly after at a considerable profit? Or you borrow money to invest in NFTs?

Then you’re considered a speculator and have to pay tax on your profits. This ‘miscellaneous income’ is taxed at 33%. You can, nevertheless, deduct any losses from previous years from these gains.

- Professional trader: NFT profits considered as professional income

If you regularly buy and resell NFTs, the tax authorities will consider you a professional trader. Your profits will therefore be subject to income tax.

Depending on the tax bracket you fall in, you can quickly reach an income tax rate of 50%. If you’re likely to find yourself in this situation, it’s better to set up a company for your investment activity, as corporate tax rates are a lot more advantageous.

Should I add capital gains on my NFT sales in my tax return?

As we’ve seen, there are several possible scenarios, some of which are more favourable than others:

- Prudent investor: no tax

- Speculator: 33% tax on miscellaneous income

- Professional trader: personal income tax (up to 50%) or corporate income tax (25%)

As a small investor with a limited number of NFTs, you would of course prefer to be considered a prudent investor. You don’t have to declare your NFT profits, but make sure you can prove your prudent investor profile if you get a visit from the taxman.

If you have a lot of NFTs and make a substantial profit from them, then you no longer fall into the prudent investor category, and you have to pay tax. In this case, check in advance which profile best reflects your activity, and take the necessary steps to ensure you declare the income correctly.

Accountable also helps you correctly declare capital gains on your NFTs

As we’ve explained, there are different ways to declare capital gains on NFTs, and this depends on your investor profile.

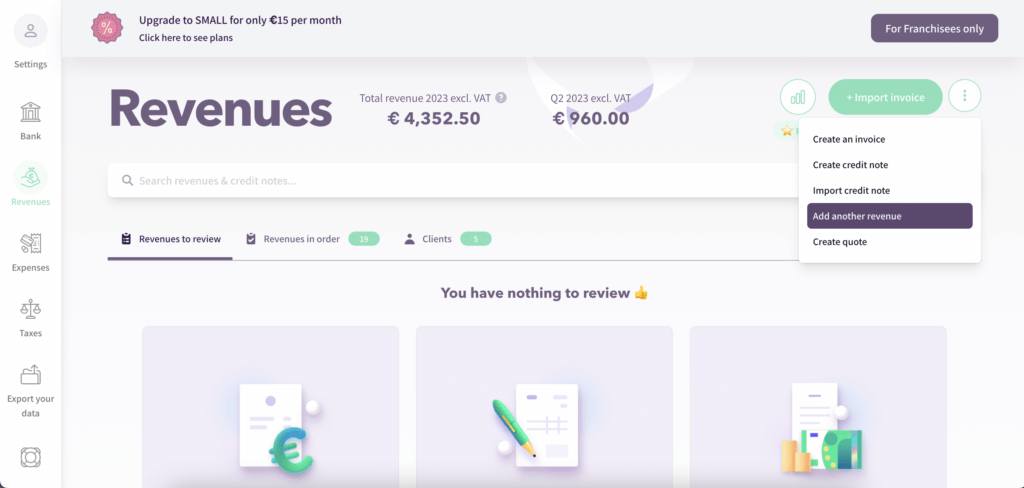

How do I add income from NFTs as ‘speculative income’ in Accountable?

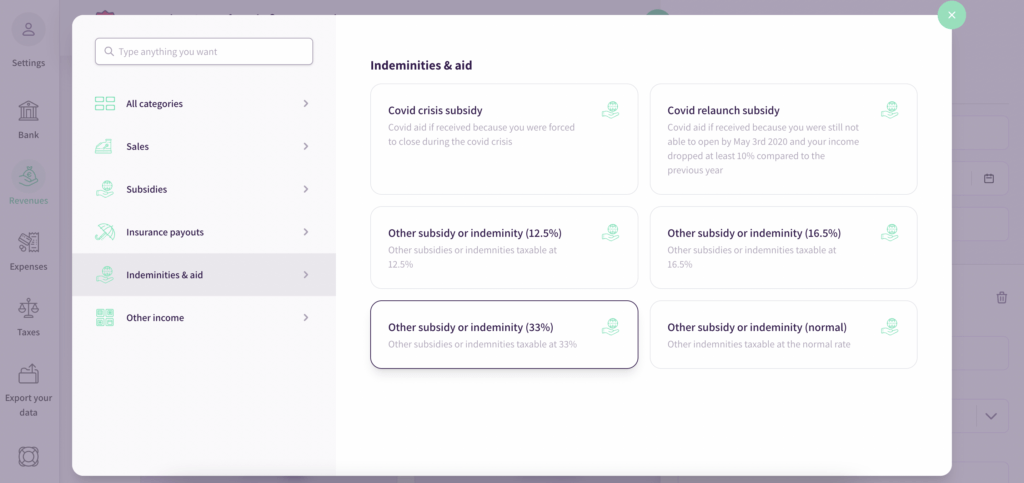

- Go to the ‘Create an invoice’ menu and click ‘Add another revenue’.

- Under ‘Category’, select ‘Indemnities & aid’, then ‘Other subsidy or indemnity (33%)’.

How do I add income from NFTs as ‘professional income’ in Accountable?

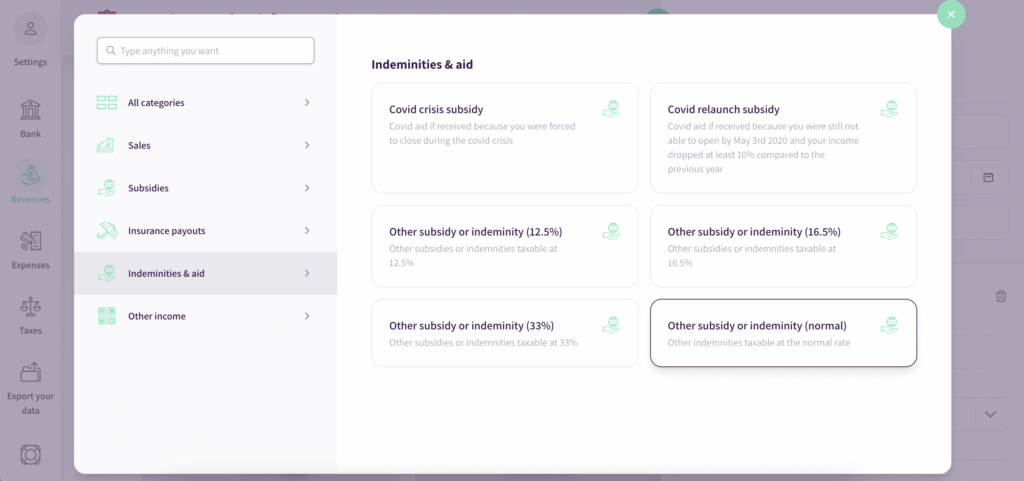

- Go to the ‘Create an invoice’ menu and click on ‘Add another revenue’.

- Under ‘Category’, select ‘ Indemnities & aid’, then ‘Other subsidy or indemnity (normal)’.

This income will then be taken into account in your personal or corporate income tax declaration, depending on the form of your business.

Whether you’re a prudent investor, speculator, or professional trader, Accountable helps you correctly declare your NFT income. Best of luck with your investments!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.