How does Accountable compute my taxes?

You import or create your invoices: the app captures the information necessary for the tax calculation.

The same happens with your receipts: you scan them, we recognise amounts, dates, VAT rates, and apply the right category.

Based on the category, we apply the right deductibility for your income tax and VAT and we calculate the amount you will pay or get back for each tax.

Those computations are certified by our internal team of accountants and partner accountants. They are regularly reviewed and always up to date.

Your accountant, if you choose to invite your accountant to Accountable, has access to each individual computation on their platform. They can modify the deductibility of expenses if they believe it should be different.

Is it safe?

Accountable works with a team of internal & partner accountants. Those accountants certify the computation made in Accountable. They constantly monitor law changes and impact the app accordingly.

If you have any questions about a specific tax result, we are naturally happy to investigate with you. We are accountable, accountable for the results we provide you with.

Do you cover all of my taxes?

Yes, we cover every tax of all Belgian natural persons (*eenmanzaak* in Dutch, *personne physique* in French):

- Income tax, incl. prepayments

- Social contributions

- VAT declarations, incl. Q4 advance payments

- Intracom listings

- Client listing

- Profit & loss statement

We also send you reminders for each of these tax obligations: we get you covered and make sure you feel in control of your taxes.

We don't cover company taxes and the filling of a yearly balance sheet, which are 2 additional tax obligations for limited companies in Belgium. We can recommend you a partner accountant that can help you with those, based on your Accountable data.

How can I be sure that my taxes are filed correctly?

We work hand-in-hand with certified accountants and tax advisors, at every step of the app development. We are committed to the highest quality standards and we invest primarily in the app itself.

We would naturally compensate for tax mistakes originating from the software if any. If you would encounter a mistake in a tax return, our Customer Success team would help you get it sorted out in no time.

In other words: your trust is our most valuable asset. We won't mess with it. We will always go for the safest solution, even if that implies more work and costs for us.

Is my data automatically shared with the tax administration?

No, your data is not shared with anyone and certainly not the tax administration.

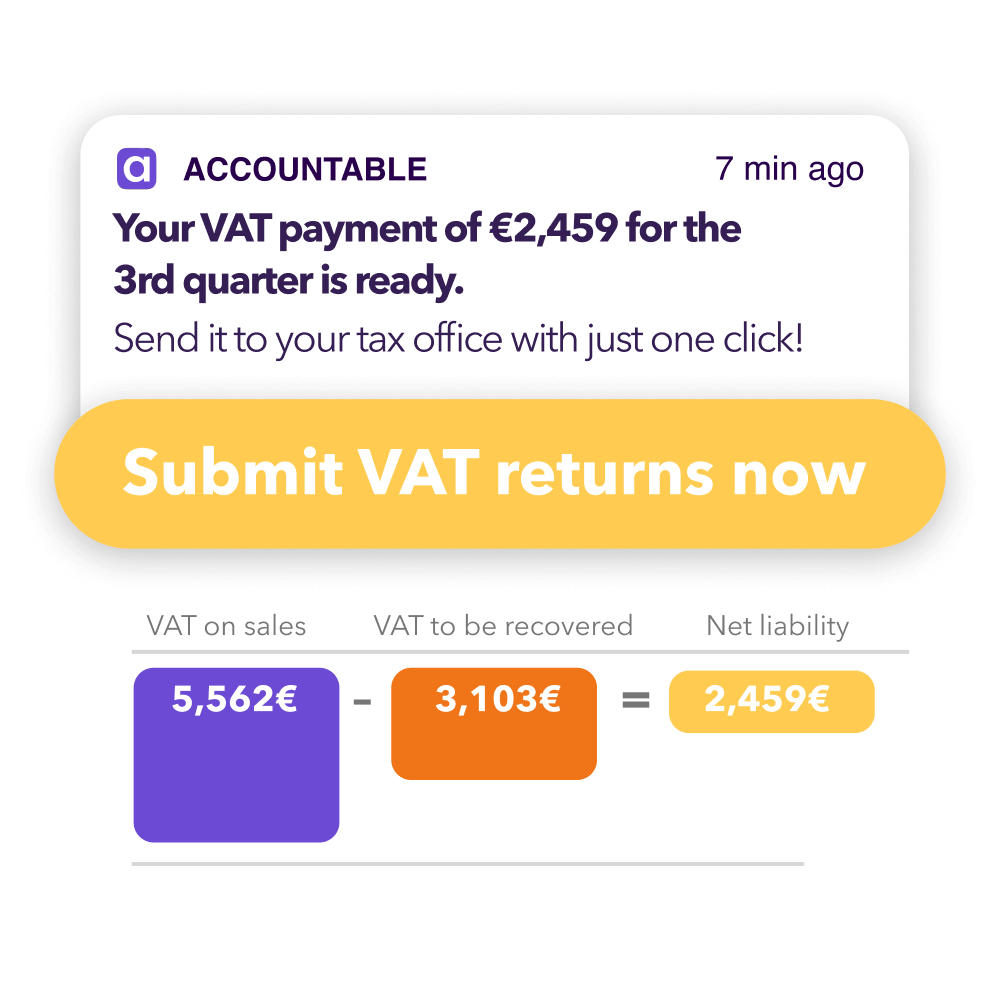

When you decide to submit your VAT, client listing or income tax, you get a file that you can drag & drop on the site of the tax authority in a matter of minutes.

What if I have a tax question?

Our Customer Success team is available to answer your tax questions here. With the support of our partner accountants, they are building a knowledge bank to be able to support you as necessary.

Would you need the support of a tax advisor or a certified accountant for a specific question, you could book their services here, from our network of partner accountants. They could help you based on your personal situation if you grant them access to your Accountable data.

Can I share Accountable with my accountant?

Yes, of course! You can use Accountable with your accountant, with one of our partner accountant or on your own.

You can easily do it: choose "share with your accountant", they will receive an invitation to our platform dedicated to accountants.

They will be able to review your documents, validate them, generate and later submit your tax returns, at no extra cost nor for you nor for them.

Can my accountant file my taxes using Accountable?

Yes! They can join our free platform for accountants, Expert.

On Expert, they can review and validate your documents (invoices and receipts). They can generate your VAT return and the calculations for your income tax (the professional part) in a couple of clicks.

You do not have to pay extra for this, nor your accountant: we want you to choose the set-up that works best for you.

At all times, you know how much you will pay

At all times, you know how much you will pay  We calculate the right prepayments for you

We calculate the right prepayments for you  When filing, you know which amounts to input ineach section of the declaration

When filing, you know which amounts to input ineach section of the declaration

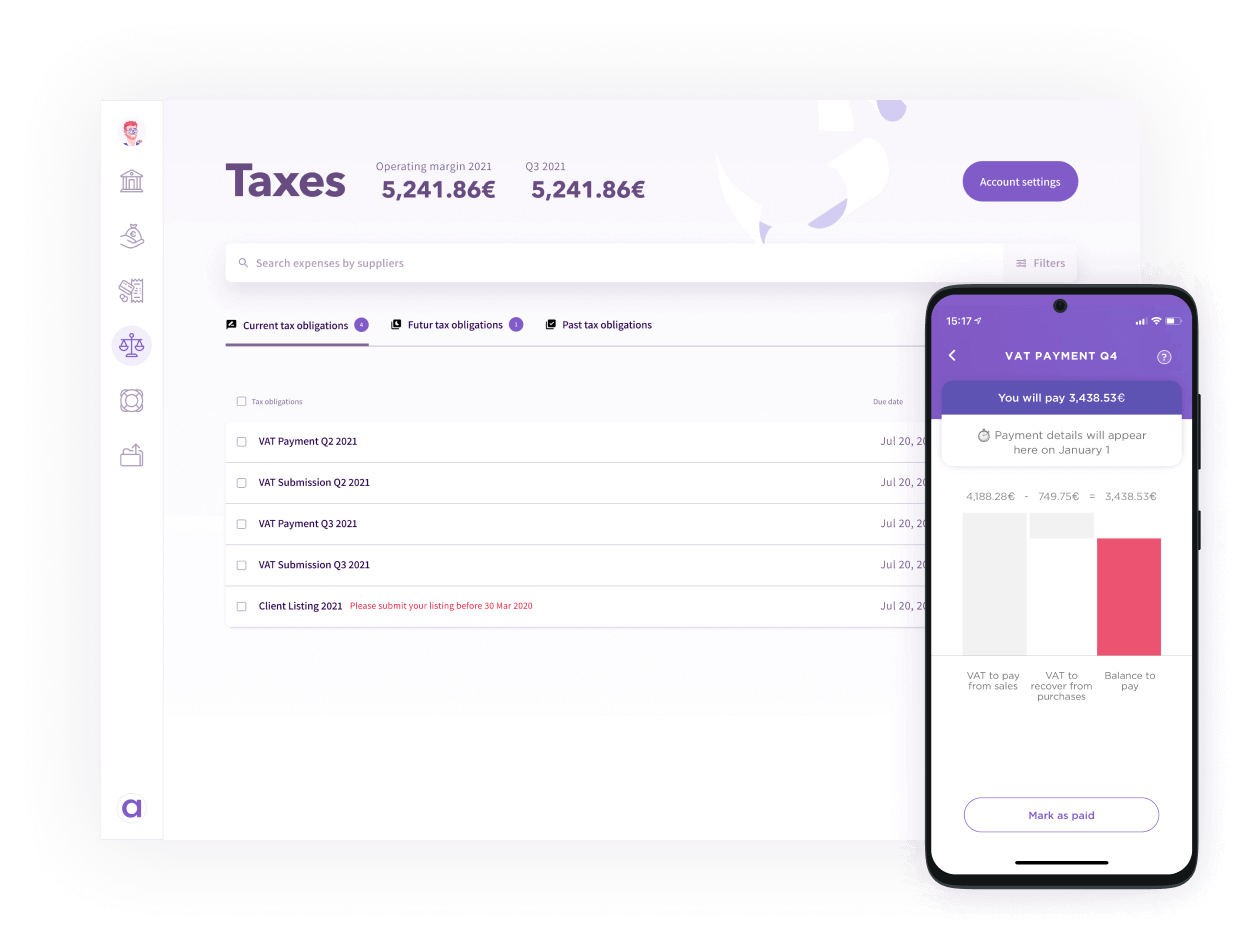

You know at any time how much VAT youwill pay or recover

You know at any time how much VAT youwill pay or recover  Get your declaration automatically

Get your declaration automatically  We remind you for each tax deadline

We remind you for each tax deadline

Know how much you should contribute,given your current revenue

Know how much you should contribute,given your current revenue  Receive alerts when you pay too little

Receive alerts when you pay too little  Works with any social security provider

Works with any social security provider