As a self-employed person in Belgium, you are obliged to submit a client list every year in March.

On this page you can read whether this obligation also applies to you, which customers exactly must be on the list and how to submit it correctly.

The annual client listing, or VAT listing, is a list of all Belgian companies to whom you have invoiced at least €250 (excluding VAT) over the past year.

Thanks to this client listing, the VAT administration gains valuable insights, such as which companies do business with each other.

You must always submit the customer listing for your clients from the previous year before the 31st of March via Intervat.

⚠️ So, do not confuse the terms.

If your customers are mainly private individuals or do you mostly invoice smaller amounts? Then there's a real chance that your client listing remains empty. Depending on the type of business, there are important differences for the 'nihil' listing:

On the VAT or customer listing, you mention:

The following customers do not need to be on the customer listing:

There are two different ways to prepare and submit your client listing.

Step 1: Export your client listing from your accounting software

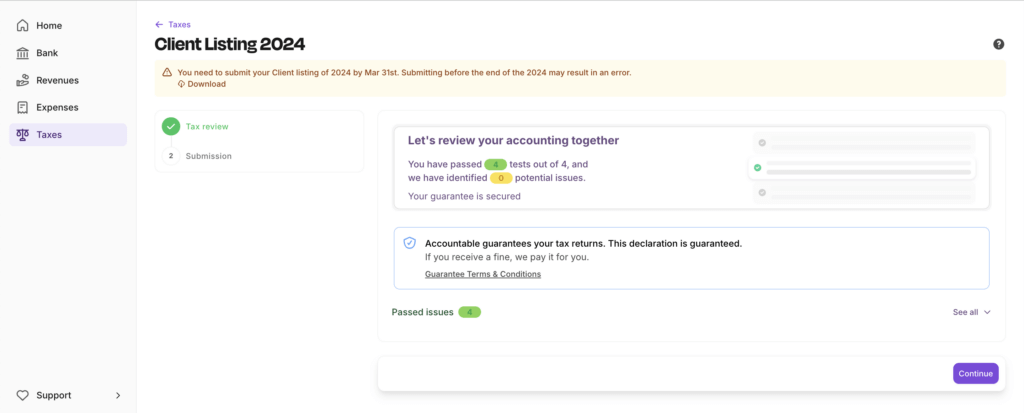

With Accountable, follow these steps:

Step 2: Log in to Intervat

As a sole proprietor, select your own name when logging in. If you have a company, choose your business.

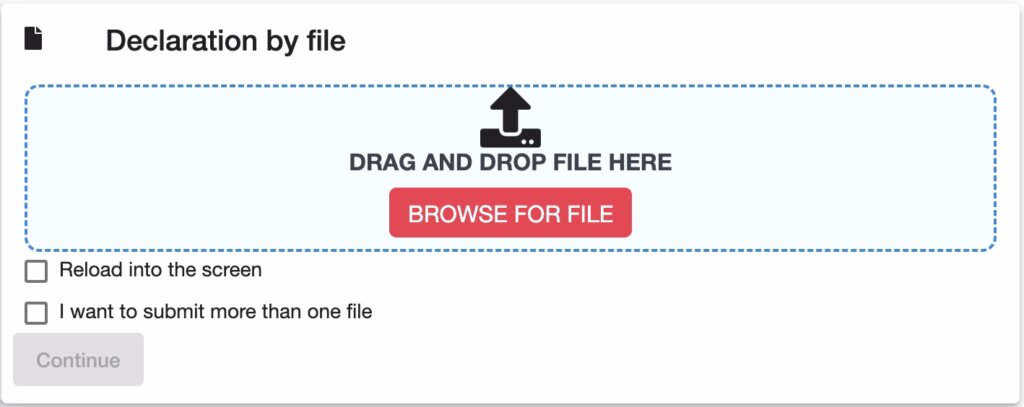

Step 3: Upload your VAT listing

Step 4: Submit your client listing

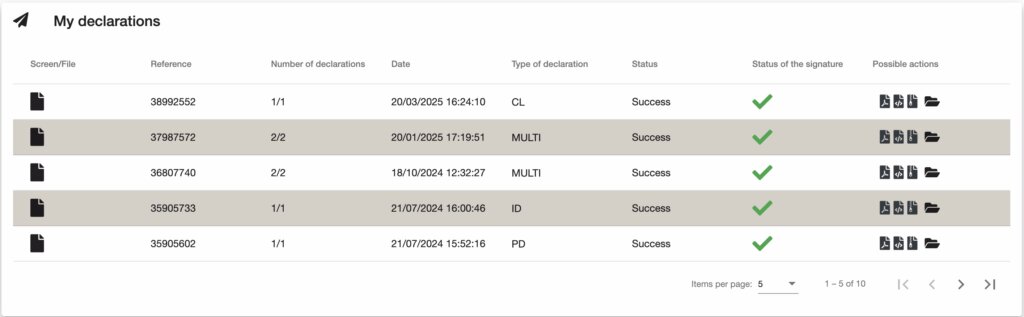

Step 5: Check if your VAT listing was submitted

Step 1: Review your client list from the past year

Select the following clients:

Step 2: Log in to Intervat

As a sole proprietor, choose your own name when logging in. If you have a company, select your business.

Step 3: Upload the VAT listing

You can choose to create this list in Excel; if so, select ‘Declaration via file’ in Intervat.

Alternatively, you can enter the client data directly into Intervat. If you choose this option, select ‘Declaration via screen’.

Step 4: Submit the client listing

Step 5: Check if your VAT listing was submitted

Go back to the ‘Dashboard’ tab and check if your KL is listed under ‘My declarations’ with the status ‘Success’.

💡 Need more help? Follow this detailed step-by-step guide.

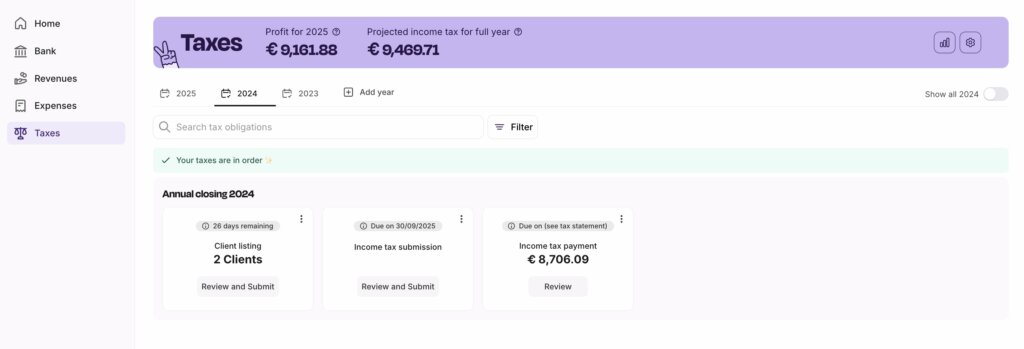

Are you an Accountable user? Then submitting the customer listing suddenly becomes a breeze.

If all your sales invoices are in Accountable, we will prepare the client listing for you. Moreover, Accountable timely reminds you of the deadline and provides instructions for submission via Intervat. If only life could always be that simple.

With Accountable, the VAT listing becomes a minor administrative obligation, which you can easily manage yourself. Want to know what the customer listing looks like and what more Accountable can do for you? Discover our app here.

Author - Hassan Ayed

Hassan co-founded Accountable alongside Nicolas and Alexis in 2017. He is a Chartered Accountant and Tax Advisor at Catalyst.

Who is Hassan ?Thank you for your feedback!

Useful

As a self-employed individual with a sole proprietorship, your income is taxed under the personal in...

Read moreStarting from 2026, all self-employed individuals will need to send their invoices electronically in...

Read moreThe VAT reverse charge is a complicated word for a simple concept. It helps you purchase and sell sm...

Read more