Discovered a mistake in your VAT return after submitting it via Intervat? You’re certainly not the only one. The good news is that you can correct your error, as long as the statutory filing deadline has not passed. Previously, it was also possible to submit a correction to your VAT return after the statutory filing deadline, but as of 1 January 2025, this will no longer be allowed.

But how can you still rectify a mistake? Let's dive into it.

From this year, several changes to VAT regulations will come into effect. New deadlines for the submission and filing of periodic returns are being introduced, and the ability to correct errors in your VAT return after the statutory filing deadline has passed will be abolished.

But what should you do if you discover a material error in your VAT return after the statutory filing deadline? In that case, you can include a correction in your next return.

Before the statutory filing deadline passes, you can still correct your mistake. You do this by cancelling the previous return and replacing it with the correct one.

⚠️ Please note, this is only possible if the statutory filing deadline has not yet passed!

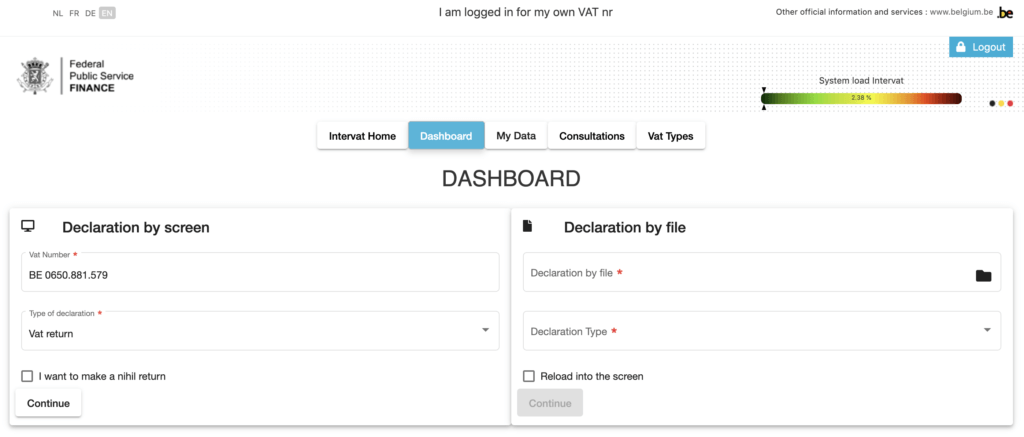

Go to Intervat (you can use this link) and log in.

If you want to adjust a return for your sole proprietorship, select "in own name." If you have a company, select "on behalf of a business."

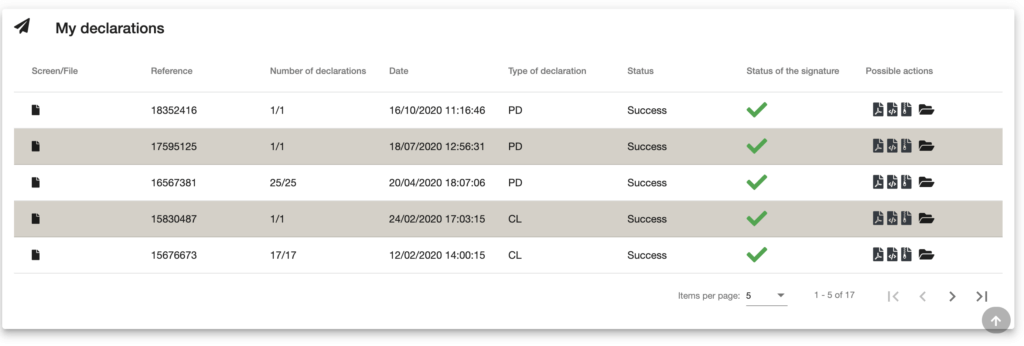

Go to 'My declarations' and cancel the previous return.

Then upload the correct return. You can do this as you normally would, either by file or by screen.

Don't understand something about Intervat or have a question about your VAT return? Feel free to contact our Tax Coaches. We’re here to help. ✨

Not using Accountable yet? Through our app, you can easily access all the information you need to submit your VAT return without errors. Plus, we offer a guarantee for your tax returns. If you receive a fine, we’ll cover it.

Artyom Ghazaryan

Artyom is Head of Accounting at Accountable, and a chartered Accountant & Tax Specialist.

Thank you for your feedback!

Useful

As a self-employed individual with a sole proprietorship, your income is taxed under the personal in...

Read moreStarting from 2026, all self-employed individuals will need to send their invoices electronically in...

Read moreThe VAT reverse charge is a complicated word for a simple concept. It helps you purchase and sell sm...

Read more